Questions about liquidation pref

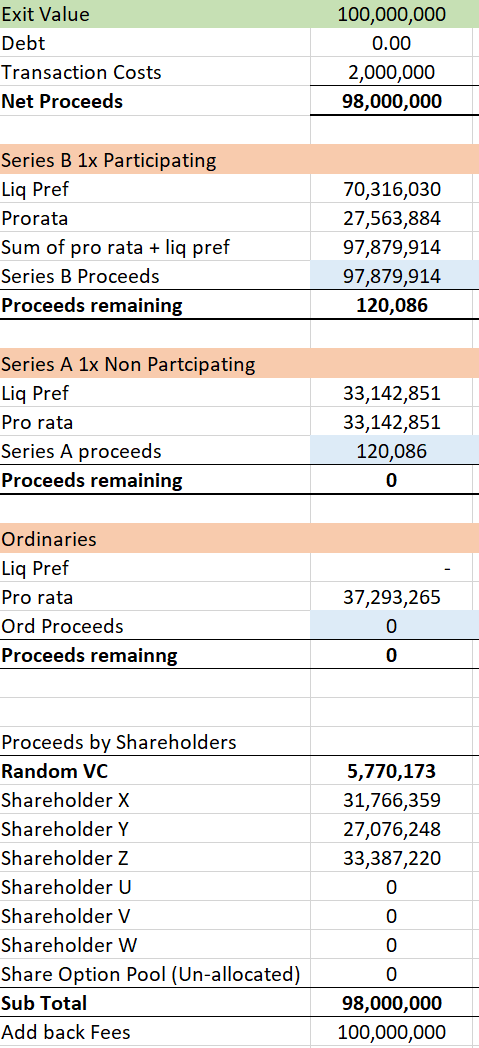

In my spare time I've been practising things like cap tables, CLN conversions and Liq pref, i have been able to understand where multiple investors have 1x Non-participating they essentially choose their liq pref until their pro rata share is higher. The remainder flows down to the next investor. Im still struggling slightly with 1x Participating say series B being the most senior get their proceeds first and they invested in the A as well as having a portion of ordinaries.

- The Liq pref total is 70m

- Pro-rata share of a 98m Exit event is 27m,

In this example does the proceeds for this 1x participating proceed equal the Liq pref + their pro rata of their Series B shareholding or is just the liq pref and then the money flows through.

I attached a screen shot of my assumptions:

I find it easier to think about it from a shares basis. For a participating preferred, they get the 1x and keep their shares which will be worth whatever the common PPS is.

That makes sense so essentially what actually happens is my Series B investors gets their guaranteed cash so 70m in this case and if they are the only participating pref share class then everyone converts to common and you get your %FD of shares

Yea your payoff is principal + % equity. Investors love it. You get your slice of the cake and can go for seconds. You've made a return on day 1. Companies naturally hate it.

I think it's wrong above or maybe I can't read it. Series B gets to double tap in the same proceeds pool as common. The as-if converted piece is not "preferred" only the principal. Treat the principal payment(s) like debt after which all rest is equity

That makes sense im realising now it looks abit more like this, Series B get their guaranteed, everyone converts to common so its just my pro rata ownership of the company times the remaining proceeds for common

Aut ut necessitatibus blanditiis quae maiores. Repudiandae quisquam error voluptatum voluptatem quod recusandae. Quod eos nihil temporibus consequatur vitae. Molestiae deserunt omnis enim consequatur repellat. Dolorum quos nulla explicabo atque neque est modi doloremque.

Et ipsum dolor et laboriosam aut aut. Veniam assumenda aut nihil exercitationem et sint.

Officia pariatur rerum ex non cum. Quia ea qui recusandae ut quo quod magnam. Est ea qui numquam sed. Aliquam rerum repellat eum impedit ipsam dicta eligendi sunt.

Quasi aliquam sit quas tempora molestiae est. Omnis quis dolorem et soluta dolor quaerat. Voluptates molestiae assumenda in. Reprehenderit quasi rem soluta culpa ducimus.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...