Financial Statements for Banks

Typically include balance sheet, income statement, cash flow statement, and statement of changes in equity

What Are The Financial Statements for Banks?

Banks' financial statements typically include balance sheet, income statement, cash flow statement, and statement of changes in equity.

A bank is a financial entity permitted to accept deposits and provide loans. Banks can also offer financial services, including wealth management, currency exchange, and safe deposit lockers.

Banks are classified into three types: retail, commercial, corporate, and investment. In most nations, the national government or central bank governs banks.

Banks' reported financial statements differ from those of most companies studied by investors. Unlike many non-banking companies, banks do not typically have inventory but have receivables (such as loans) that contribute to their revenue.

A distinguishing feature of bank financial statements is the balance sheet and income statement layout. Once investors understand how banks generate revenue and how to analyze what drives that revenue, they will still be able to interpret bank financial statements.

Individuals or businesses can make deposits. Banks accept deposits from people and invest them in securities or lend them money.

Because banks earn or receive interest on their loans, this is a contributing factor to their profit. The spread between the rates they charge for deposits and the rates they earn or receive from borrowers is called the interest rate spread.

Banks also earn interest by investing their cash in short-term securities, such as US Treasury bills. They also earn revenue from fees associated with their products and services and checking account fees. These fees include overdraft fees, ATM fees, credit card fees, and interest.

Its role is to manage the spread between the rates it pays on deposits and the rates it receives on loans. The interest rate generates income for a bank when it earns more interest on loans than it pays on deposits.

The size of the spread, the Federal Reserve's monetary policy, US Treasury yields, and other factors influence a bank's profit.

Key Takeaways

- Banks accept deposits, offer loans, and provide various financial services. They're classified into retail, commercial, corporate, and investment banks, regulated by national governments or central banks.

- Unlike non-banking companies, banks' financial statements emphasize receivables like loans rather than inventory. Understanding how banks generate revenue is crucial for interpreting their balance sheets and income statements.

- Banks earn revenue primarily through interest on loans and investments, as well as fees from various services like credit cards and overdrafts. Managing the spread between deposit and loan interest rates is crucial for profitability.

- Banks must manage risks such as interest rate risk, credit risk, and liquidity risk. Interest rate fluctuations can impact profitability, while credit risk arises from potential loan defaults. Liquidity risk involves meeting short-term obligations.

- Analyzing bank financial statements requires unique ratios like the capital adequacy ratio (CAR), net interest margin, loan-to-assets ratio, and return-on-assets (ROA) ratio. These metrics provide insights into a bank's financial health and profitability.

How to Analyze Financial Statements for Banks

When analyzing bank stocks, someone should be aware of the following metrics:

- Whether investing through mutual funds or stocks, it is difficult for an investor to avoid banks or financial firms

- Bank financial statements can be a black hole of information. Having a lot of numbers can cause more confusion than clarity

- Banks utilize different metrics compared to non-financial firms for assessing their financial performance and risk

To analyze a bank's financial statements, one must first understand these metrics. In this article, we've reviewed some of the most important metrics for researching a banking firm.

The capital adequacy ratio (CAR) is the ratio of a bank's available capital to the risk of its loans. CAR protects depositors while also promoting financial system stability and efficiency.

It aids in determining a financial institution's financial strength—the ability to meet its obligations using assets and capital. The CAR indicates how well-capitalized a bank is.

Non-performing assets, gross and net non-performing assets (NPAs), measure how much of a bank's loan portfolio is at risk of default. If a loan is not paid for 90 days, it becomes non-performing.

Gross and net NPAs are two types of non-performing assets. The net NPA is calculated by subtracting the bank's provisions from the gross NPA, including the loan's principal and interest.

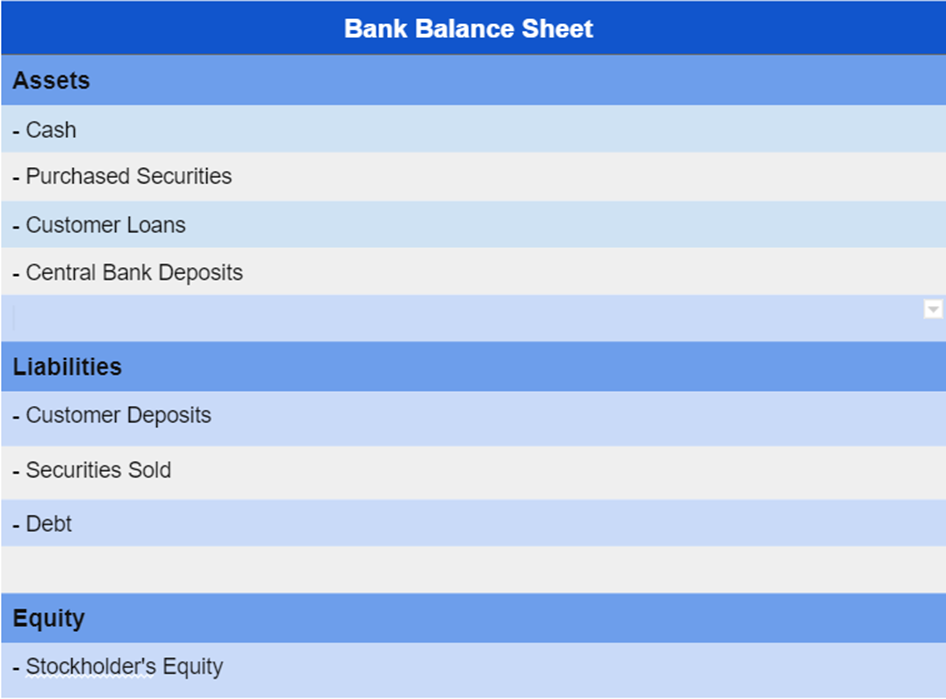

Financial Statements for Banks: Balance Sheet

Assets are equal to liabilities plus the company's equity, which is one of the basic accounting principles. Banks and non-financial entities have this in common but diverge after that.

Besides that, banks are subject to several regulatory requirements, which alter the Reserve requirements. The Federal Reserve determines the amount of reserve requirements. Banks with deposits exceeding $182.9 million ($127.5 million in 2020) must maintain a 10% reserve.

As of 2021, banks with reserves of between $21.1 million ($16.9 million in 2020) and $182.9 million ($127.5 million in 2020) must maintain a 3% reserve.

Following the 2008 financial crisis, the Basel Committee enacted the Basel III Accords. To protect banks from economic shocks, certain regulatory capital requirements were updated.

The accords specify minimum capital, leverage, and liquidity requirements that banks must meet to enhance their stability and resilience.

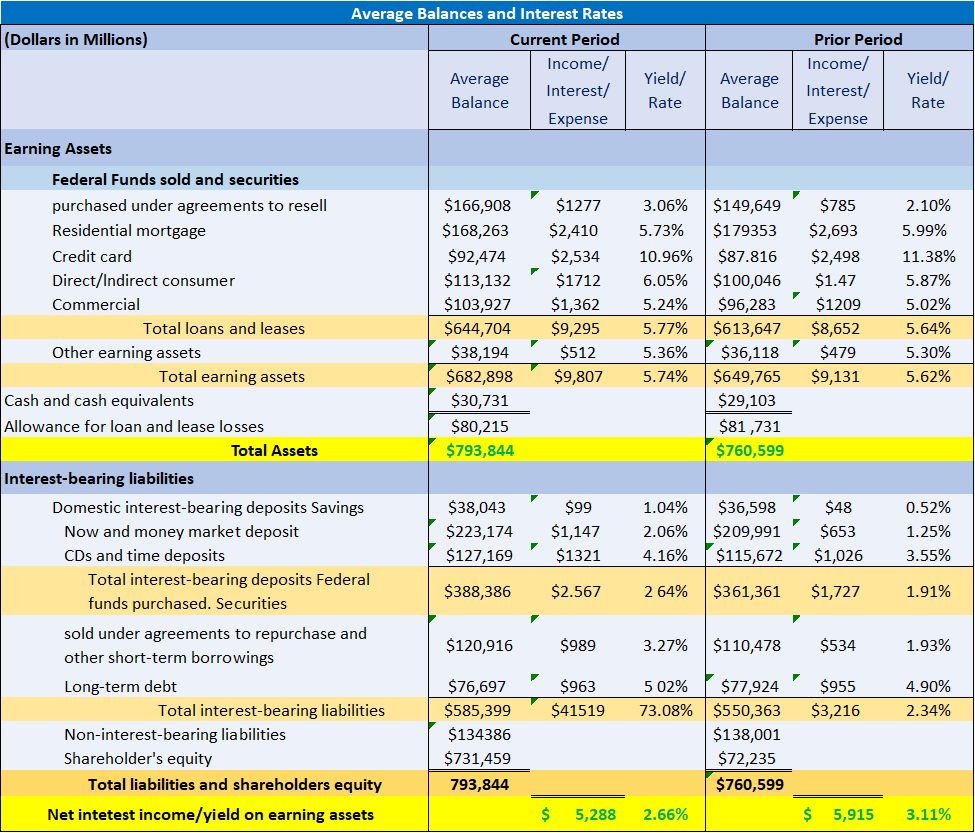

The table below illustrates how to earn assets and interest-bearing deposits. It also yields the bank's balance sheet and income statement. The majority of banks use this sort of table in their yearly reports.

The table below depicts the same bank as in the preceding examples:

Assets and Liabilities

Liabilities represent obligations and do not depreciate, while assets contribute to a company's value and equity. The greater the difference between your assets and liabilities, the better your company's financial health.

If a company's obligations exceed its assets, it may face financial challenges, which could lead to business failure.

Assets are frequently classified according to their liquidity or how fast they may be converted into cash. Cash is the most liquid asset on your balance sheet since it may be used to settle a debt immediately.

Note

An illiquid asset like a factory is the polar opposite because the selling procedure (changing the property to cash) is likely to be lengthy.

Current assets are the most liquid assets. Cash, marketable securities, inventories, and accounts receivable are examples of assets that may be converted to cash in less than a year. These assets bring in money for your business.

Fixed assets are non-liquid assets that are bundled together. Real estate, automobiles, and machinery are examples of fixed assets. These assets belong to your organization and contribute to revenue, but they are not consumed in the income-generation process and are not kept for cash conversion.

These tangible goods often require a large capital investment and last a long time. Banks earn money primarily through lending operations, where they provide loans to clients and generate revenue through interest income.

Often, these companies take customer deposits and pay a small interest rate. Then, they lend some of those deposits to other customers as loans at a higher interest rate.

A bank makes money by spreading interest rates. Customer deposits are listed as liabilities on a bank's balance sheet, reflecting the bank's obligation to return the deposited funds upon request.

Bought securities are assets acquired through trading operations, with the expectation that their value will increase. If their value decreases, they still remain assets on the balance sheet.

The central bank deposits line item shows how much money banks keep in reserve funds. The capital is required by law for reserve requirements. These deposits are the bank's property.

Financial Statements for Banks: Income Statement

The income statement is one of three primary financial statements that reflect a company's financial performance during a certain accounting period. The balance sheet and the statement of cash flows are the other two.

The income statement, also known as the profit and loss statement or the statement of revenue and expense, focuses on the company's earnings and costs during a specific period.

The income statement of a bank is divided into two categories:

- Interest income: Interest income is the money earned from lending out customer deposits and the interest earned on financing

- Non-interest income: Non-interest income encompasses all a bank's other business activities

Non-interest income for banks may include earnings from:

- Credit card fees

- Underwriting fees

- Overdraft fees

- Transaction fees

- And other sources

Interest expense, representing the cost of borrowing funds or paying interest on deposits, is deducted from interest-related revenue on a bank's income statement.

Note

A significant line item on a bank's income statement is "provisions," which are set aside for expected credit losses, including loans that may default. This appears as a "loan loss provision" on the income statement.

bank's risk And the financial statements for banks

Every business must deal with risks in its operations. Risks will differ for each company depending on the type of business, industry, and economic environment. Interest rate and credit risk are two of the most important risks a bank must manage.

1. Risk of Interest Rates

As stated, banks earn interest on deposits they lend out as loans. The revenue a bank earns is determined by the amount of interest it can charge.

The interest rate environment can benefit or hinder a bank's profits depending on the current economic climate. Banks earn more on their loans in high-interest rate environments and less in low-interest rate environments.

The interest rate environment can also influence non-interest-earning sections of a bank's operations. Consumers may hesitate to acquire houses in a high-interest rate environment because they will pay higher mortgage interest rates.

As a result, mortgage demand will fall, as would any non-interest revenue, such as mortgage-related fees.

2. Credit Danger

Credit risk occurs when a bank offers a loan to an individual or firm. The danger is that the borrower will default and be unable to repay the loan.

Banks do extensive credit risk assessments on borrowers before providing a loan, yet surprising defaults still occur. A bank incurs losses as a result of a default. However, reserves are set aside to cover these losses.

3. Liquidity Risk

A bank's capacity to obtain funds to satisfy financing obligations is referred to as liquidity risk. One obligation is allowing clients to withdraw their deposits. The inability to give funds to consumers on schedule might have a snowball effect.

If the bank delays transferring cash to a few clients for a day, other depositors may rush to withdraw their funds as they lose faith in the bank. This further reduces the bank's capacity to supply cash, resulting in a bank run.

Banks experience liquidity challenges due to overreliance on short-term sources of cash, a balance sheet concentration in illiquid assets, and customer loss of confidence in the bank.

Note

Mismanagement of asset-liability duration can also lead to financial problems. This happens when a bank has many short-term liabilities but not enough short-term assets.

Customer deposits or short-term guaranteed investment contracts (GICs) that the bank must pay consumers are examples of short-term obligations. If a bank's assets are completely or mostly tied up in long-term loans or investments, the bank may face an asset-liability duration mismatch.

There are regulations in place to help with liquidity issues. They include a need for banks to keep enough liquid assets to exist for a period of time, even if no outside funds are injected.

Using Financial Ratios for Analyzing Financial Statements of Retail Banks

Several key financial ratios can be used to analyze retail banks:

1. Financial Ratios in Banking

Net interest margin, loan-to-assets ratio, and return-on-assets (ROA) ratio are among the important financial parameters used by investors and market analysts to analyze firms in the retail banking industry.

Analyzing banks and banking stocks is challenging due to their unique operational and profit-generating mechanisms compared to most other firms. While other companies develop or manufacture goods for sale, a bank's principal product is money.

Note

Banks' financial statements can be complex, requiring careful analysis due to the nature of their operations and financial activities. Investors considering bank stocks utilize classic equity indices.

In addition to examining the price-to-book (P/B) or the price-to-earnings (P/E) ratio, they also examine industry-specific indicators to analyze particular banks' investment prospects more precisely.

- Banks and banking stocks are particularly difficult to analyze since they operate and produce profit in ways that most firms do not

- Net interest margin is a key indicator in bank evaluation since it displays a bank's net profit on interest-earning assets such as loans or investment securities

- Banks with a greater loan-to-asset ratio earn more money from loans and investments

- Banks with lower loan-to-asset ratios obtain a higher proportion of their overall revenue from more diverse, non-interest-earning activities, such as asset management or trading

- The return-on-assets ratio is an essential profitability statistic that indicates the profit per dollar invested in a company's assets

2. The Retail Banking Sector

The retail banking business encompasses banks that offer direct services to individual clients, such as checking accounts, savings accounts, investment accounts, and lending services.

However, most retail banks are commercial banks that serve both corporate and individual customers.

Retail banks and commercial banks traditionally function independently of investment banks, while the repeal of the Glass-Steagall Act now permits institutions to provide both commercial banking and investment banking services.

Loans and services generate revenue for the retail banking business and the banking industry as a whole. When examining retail banks, investors look at profitability metrics that provide the most relevant performance assessments for the banking business.

Note

The retail banking sector in the United States is separated into four large money center banks: Wells Fargo, JPMorgan Chase, Citigroup, and Bank of America, as well as regional banks and thrifts.

3. Margin of Interest

Because it displays a bank's net profit on interest-earning assets such as loans or investment securities, net interest margin is an extremely relevant indicator in evaluating banks.

Because interest on such assets is a significant source of revenue for a bank, this statistic is a solid predictor of overall profitability, and greater margins usually imply a more profitable bank.

Various factors, including interest rates charged by the bank and the source of the bank's assets, can substantially influence the net interest margin.

Net interest margin is computed by taking the sum of interest and investment returns minus related expenditures and dividing it by the average total of earning assets.

4. The Asset-to-Loan Ratio

Banks with higher loan-to-assets ratios earn more from loans and investments, whereas banks with lower loan-to-assets ratios earn a bigger share of their overall revenue from more diverse, non-interest-earning sources, such as asset management or trading.

Banks with lower loan-to-asset ratios may perform better when interest rates are low, or credit is scarce. They may also perform better during recessions.

5. The Return-on-Assets Ratio

The return-on-assets (ROA) ratio is commonly used in bank analysis due to its simplicity and effectiveness in assessing a bank's profitability relative to its assets.

The ratio is considered an important profitability ratio and indicates the company's per-dollar profit on its assets. Since bank assets consist of money and bank loans, the per-dollar return is an important metric of bank management.

The ROA ratio is a company's net after-tax income divided by its total assets. Since banks are leveraged, even a low ROA of 1 to 2% may represent large revenues and profits for a bank.

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?