Security

Financial instruments that generally represent ownership or debt

What is a Security?

Securities are financial instruments that generally represent ownership or debt. These generally represent ownership or debt and include various marketable financial assets, but the classification may vary based on legal definitions.

When it comes to accounting, financial statements always come to mind. This is because financial instruments are, in essence, contracts and therefore are at their core financial assets.

An example would be when an invoice is issued on sales done by credit. The party that has made the deal has a financial asset—the accounts receivable—while the party that purchases the goods has to account for a financial liability—the accounts payable.

Securities are financial instruments representing ownership or debt that can be publicly traded among individuals or organizations. There are various financial instruments, such as bonds, stocks, and even invoices. Three common types of securities include :

- Equity securities, which grant ownership rights

- Debt securities, which represent loans with periodic repayments

- Hybrid securities, which combine characteristics of both equity and debt instruments

The primary motivation for purchasing securities is typically investment, aiming to generate income, gain capital, diversify portfolios, manage risks, or hedge against losses.

Key Takeaways

- Securities are financial instruments representing ownership or debt, including various marketable assets like bonds, stocks, and derivatives.

- Securities can be categorized into equity securities (granting ownership rights), debt securities (representing loans with periodic repayments), hybrid securities (combining equity and debt characteristics), and derivatives (contracts with underlying securities).

- Marketable securities, such as stocks, bonds, mutual funds, and certificates of deposit, can be easily bought and sold in public markets, contributing to a firm's liquidity.

- Investors typically purchase securities to generate income, achieve capital appreciation, diversify portfolios, manage risks, or hedge against losses.

- Securities financing involves lending securities or cash to another party in exchange for collateral or cash, allowing investors to gain future financial benefits without physically holding the assets.

Types of Securities

The high liquidity of marketable securities, their monetary benefits, and the prospect of price appreciation make them very popular among individual and corporate investors.

Marketable securities can be debt or equity securities, and sometimes they may be classified as hybrid securities or derivatives. Derivatives represent contracts with underlying securities.

The entity that creates these financial instruments and offers them for sale is known as the issuer. Investors are those who purchase them.

Marketable securities traditionally serve as investments and a means for entities to raise capital, with firms potentially earning significant funds during an initial public offering (IPO).

In general, marketable assets can be classified into four types:

Debt securities

Debt securities such as company bonds, government bonds, or even certificates of deposits are a type of easily exchangeable loan. Debt securities, such as bonds, represent a promise from the issuer to repay the investor at a specified time with interest, similar to an IOU.

Holders of these instruments lend a certain amount of cash to another party in exchange for the principal amount to be paid back along with interest.

The issuer is obligated to make periodic interest payments to the holder until the bond matures; upon maturity, the issuer must repay the principal amount to the bondholder.

Debt securities involve the temporary use of the investor's capital by the issuer. In addition, it allows the owner to gain periodic interest payments against the debtor's temporary use of their cash. The most common type of this kind of asset is bonds.

Bonds are units of corporate or government debt issued by an organization and traded as marketable assets.

Bonds are debt instruments that represent loans made to the issuer. Governments and businesses commonly issue bonds to borrow money in times of low liquidity or when much money is required for expansion.

Governments need to finance roads, schools, hospitals, and other infrastructure. The sudden expense of war may also require raising funds. For example, during World War 2, the US government mainly raised war funds through bonds.

Note

Companies often borrow money for various purposes, including expansion, acquisitions, capital investments, and operational needs. Large organizations sometimes require more funds than banks can provide, leading them to issue debentures to the public to raise capital.

Equity securities

Equity investors buy stocks in a company with the hopes that the stock will rise in price through capital appreciation and/or dividends paid from the firm's profits.

If the value of an equity investment increases, the investor's wealth grows when they sell the equity at a higher price than their initial purchase price. Equity securities are financial instruments that represent ownership in a business.

Equity securities typically grant the holder voting rights, providing them with some degree of control over the company. Shareholders in a company are paid their dividends only after debts have been paid.

Equity securities represent ownership in an organization. The financial instrument also grants the owner the right to receive dividends from the earnings of the issuer organization.

The most popular type of equity instrument is common stock, which gives its owner the right to a share of the residual earnings of the issuing company and allows them voting rights so they can be involved in the organization.

Note

Another type of equity instrument includes preferred stock. These stocks do not carry voting rights but promise preferential dividend payments. Equity securities can typically be sold to external parties, subject to any restrictions outlined in the shareholder agreement and applicable regulations, often through secondary markets.

Hybrid securities

This category of financial instruments combines debt and equity characteristics. Preferred stock represents ownership in a company and typically pays fixed dividends, but it is not comparable to bonds in terms of payout structure.

Since then, businesses have structured financial instruments in various ways. Many hybrid securities offer periodic dividends or interest payments, along with options for conversion to ownership.

Convertible debt securities may be less volatile due to the possibility of conversion into shares, potentially reducing investment risk.

The holder of a convertible debt security (convertible bond) can convert the document to a different type of asset. For example, the ability to transform a convertible into shares exemplifies how hybrid securities can reduce risk.

Another example of a hybrid would be capital notes. Capital notes have both share and bond characteristics but are unsecured and risky.

Note

Portfolio diversification can lower many of the risks these kinds of instruments carry. For example, investors could help find hybrids that might be mispriced while building a portfolio to reduce the company's risk.

Derivatives

Derivatives represent underlying assets and carry their risks. Accordingly, derivatives prices are influenced by underlying asset price fluctuations. These have been in use for centuries, with historical records showing their utilization by merchants for various purposes, including risk management and speculation.

Derivatives were introduced to solve this problem. A few common types of derivatives include swaps, options, forwards, and futures, but there are others, such as:

- Collateralized debt obligations (CDOs)

- Credit default swaps

- Mortgage-backed securities (MBS)

The main goal of such financial instruments is to reduce risk. For example, put options allow the contract owner the right, but not the compulsion, to sell a specific quantity of an underlying asset at a price mentioned above within a particular date.

Derivatives can be risky, especially for those just starting out investing, as they are more complex and challenging to understand.

Depending on the derivative type, derivatives have various purposes. For example, they project any asset's future price, avoid exchange rate issues, and hedge against asset value changes.

Security Finance

One of the essential traits of financial securities is that they are tradeable, i.e., one can easily exchange them for cash.

These contracts are considered liquid assets and are often accounted for when calculating liquidity ratios. Holding such contracts gives the holder the opportunity to gain future financial benefits.

Securities let you own the investment they represent without physically having it. The price of the contract indicates the value of the asset it represents. The Higher the price, the higher the value of the investment.

However, derivatives are an exception as they represent the instruments being traded rather than the underlying asset.

Securities financing is when an individual or organization lends securities or cash to another individual or corporation in exchange for collateral or cash. In simplest terms, it is an investment that lets you own things without holding onto them. Stocks and bonds are examples of securities.

These financial instruments are labeled as securities because they are secure financial contracts that can be easily bought or sold on open markets. The New York Stock Exchange (NYSE) is a famous example of a market where such assets can be exchanged.

An essential characteristic is for it to be fungible. In simple terms, the holder of the security has to be able to swiftly and efficiently exchange the asset for others of the same type. Just like a pound sterling note can be replaced by another, a company bond can be swapped for a company bond from the same firm.

Note

Just like all one-pound notes can increase and decrease in value but still have the same value, all company bonds can fluctuate in value but will still be equal in value to other company bonds in the same company.

Marketable Securities

In business terms, something is marketable if it can be quickly sold and non-marketable if it is difficult to sell. Marketable securities are securities easily bought and sold in a public market, such as a stock exchange. For example:

- Stocks

- Bonds

- Mutual Funds

- Certificates of Deposit

Analysts evaluate marketable securities when analyzing a business's liquidity ratio. Liquidity ratios measure a firm's ability to cover due liabilities within a year.

Investments or debts can be classified as either marketable or non-marketable securities. For example, government bonds and private company shares can be classified as non-marketable securities as they are difficult to buy and sell.

Firms generally allot cash as reserve funds in preparation for circumstances that would require them to spend a lot of cash quickly. For example, the company might want to take advantage of an opportunity to acquire one of its rivals.

Rather than keeping all of their cash idle and gaining no return, businesses sometimes purchase securities to generate extra wealth for the company. This wealth can come from payments from the asset or the asset's appreciation.

This allows the business to earn returns on a portion of its cash that might be devalued due to inflation. In addition, the company can easily liquidate its financial securities if a sudden need for liquidity arises.

Marketable securities are very safe investments. However, their low risk means that they generally offer low returns compared to riskier investments such as startup private limited company shares.

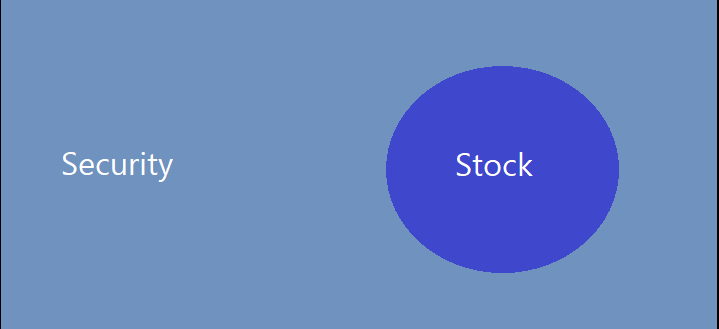

Stock VS Security

A security is a financial instrument representing ownership, debt, or other rights, that can be traded on an open market. Financial securities can mainly be classified into derivatives, debt, and equity. A stock is a specific security that gives the holder ownership in a public company.

The Venn diagram below explains the relationship, where a stock is a subset within the definition of a security.

In the past, these financial instruments were represented by pieces of paper. However, now that the stock market has become digitized, they are represented on electronic files.

Stocks are financial instruments that give the holder equity in a publicly traded corporation. In other words, owning a stock allows you to profit from a company's success while the company enjoys access to more significant capital.

Stocks represent ownership in a company, and shares are individual units of that ownership commonly associated with stocks. There are two ways to generate wealth by owning shares in a company:

- Through dividends, which are cash paid from the company's profits. So, for example, if a company has 2,000 outstanding shares and offers a $10,000 dividend, shareholders will receive $5 for each share they own

- Through Capital appreciation. This is the rise in the value of shares in the company. For example, if you buy a share for $100, and the stock is worth $170, you have made $70

Note

Owning the majority of shares in a company allows you to indirectly control it by appointing its board of directors.

The board of directors is responsible for raising the company's value and often hires competent managers and professionals such as the CEO and CFO. However, ordinary shareholders do not manage the company unless they are employees.

There are mainly two types of shares, and these are common and preferred shares. One key difference between the two types of shares is that common shares give you voting rights, whereas preferred shares give preferred liquidation rights.

Sometimes called basic shares, common shares are the most common type of stock issued by companies. But despite sharing some similarities, common and preferred shares have differences in risk-return profiles and rights assigned to them.

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?