Investment Banking Interview Questions - 15 Answers to Land the Job

ADMIN NOTE: New incredible resource released by WSO focused on investment banking interviews with over 100 sample questions and answers.

I was in your shoes about five or six years ago. I worked as an investment banking analyst at a Moelis/Houlihan/Evercore type firm in restructuring, got an offer for direct promotion to associate, passed on that to go to grad school in Europe, and have recently returned to take my associate perch in the same group. Take my word for whatever you will.

I drill my analyst interview candidates hard on technicals. Not obscure things, I just test how well they know the basics, how they think about things, and if they can apply and think on their feet a bit.

Here's a five-step plan in getting you prepared from top to bottom:

Investment Banking Interview - The 1st Impression

![]()

- The Entrance

- A simple “Nice to meet you. Thank you guys for taking the time,” is a great hello.

- Don’t flub the handshake. Stay standing until I sit down.

- Don’t come on too strong/overenthusiastic or I’ll think I will be annoyed with you the first week on the job. Sit up in your chair. Don’t wear weird socks. Fake smiles/laughs are a no-no. A quick joke is a gamble – it could be a plus, or I could just think you’re silly.

- How to Carry Yourself

- The biggest thing I am looking for is humble confidence - someone I would like to have a beer with.

- Be punchy, brief, and learn how to end a sentence. I can’t tell you how many times people have gotten into trouble by rambling off into some ass-backward irrelevant tangent. Learn to be comfortable with a little silence here and there while we absorb your answer.

- Listen, listen, listen!!! So many mistakes come from just not listening carefully and not being in the moment.

Investment Banking Fit Questions (And Answers)

![]()

You've reached the interview. This means that the firm believes you are smart enough for the job. At this point, the little things matter. Fit questions are a major part of the IB analyst interview. The focus of fit questions is to see who you are and how you would fit into the firm's culture.

- Walk Me Through Your Background/Resume

Dial-in a cohesive 90 second resume walkthrough that focuses on the positive motivating factors behind every transition (school to job, job to better job, most recent job to grad school). E.g.

"I went to school to design cars, but after one internship I realized I liked interacting with clients directly and pursued full-time roles with a sales bent. In that role, I develop solid sales skills as well as gaining exposure to a, b, and c. I wanted to continue honing those and branch out to focus on x, y, and z. I sought a new role/promotion which provided that opportunity..."

Be deliberate. Every move you made should have a reason (preferably that you initiated). Don't be negative. Never say you left because you were bored or "wanted to try something new." - Why Investment Banking?

Here's a complete guide to answering the "why investment banking" question. The reality is you need to tailor the question to yourself. It varies with your background, how substantive you want to get, and what follow-up questions you want the interviewer to ask. No matter what, the answer here should be well rehearsed as well as the scenarios that could follow.

- "Tell me about a time when...

Ideally, you can come up with 6-8 stories that cover the 30-40 basic questions, with only slight modifications. Don't wing it. For every potential question, map out the story using the SOAR framework. Describe the Situation (10-15 seconds), Obstacle (10-15s), Action (60-75s), and Result (15-30s). Stories for these questions should be 1.5-2 minutes long and focus only on what's important.

Technical Questions

![]()

- What are the Three Main Financial Statements?

The three main financial statements are the Income Statement, the Balance Sheet, and the Statement of Cash Flows. The Income Statement shows a company’s revenues, costs, and expenses, which together yield net income. The Balance Sheet shows a company’s assets, liabilities, and equity. The Cash Flow Statement starts with net income from the Income Statement; then it shows adjustments for non-cash expenses, non-expense purchases such as capital expenditures, changes in working capital, or debt repayment and issuance to calculate the company’s ending cash balance.

- If you Could Use Only One Financial Statement to Evaluate the Financial State of a Company, Which Would You Choose?

Sample Answer:

I would want to see the Cash Flow Statement so I could see the actual liquidity position of the business and how much cash it is using and generating. The Income Statement can be misleading due to any number of non-cash expenses that may not truly be affecting the overall business. And the Balance Sheet alone just shows a snapshot of the Company at one point in time, without showing how operations are actually performing.

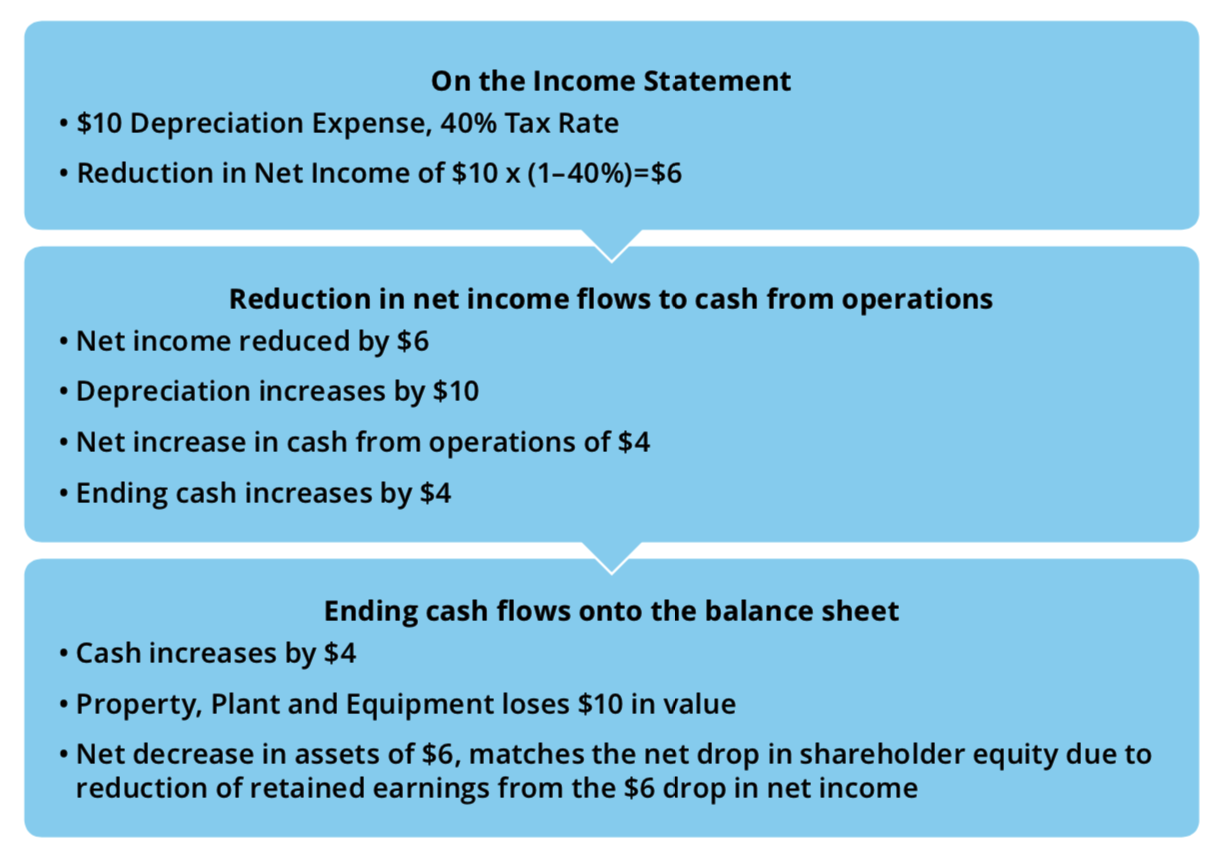

- How would a $10 increase in depreciation expense affect the three financial statements?

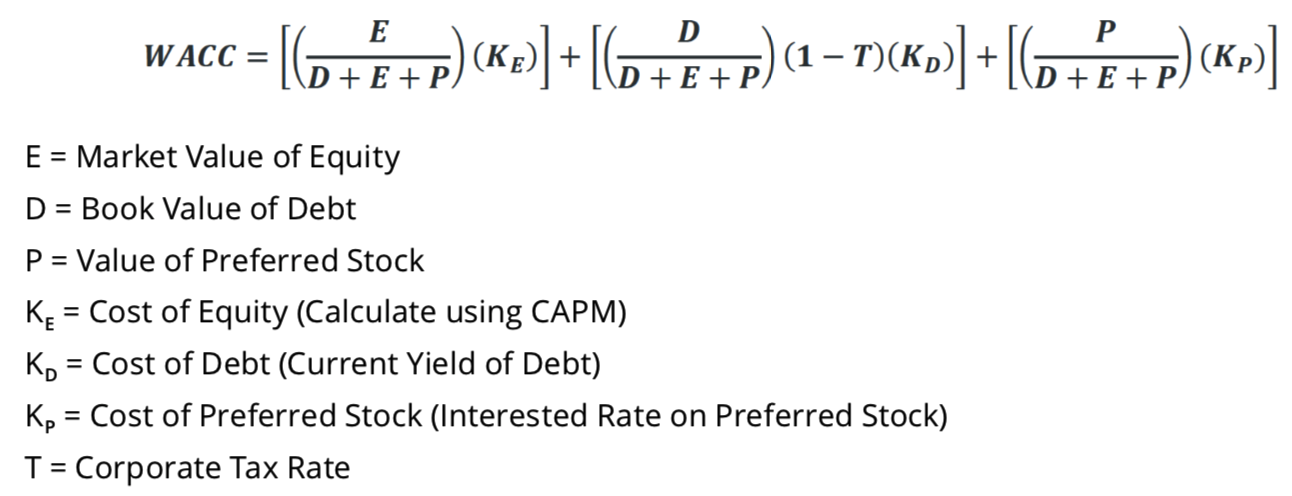

- What is WACC and how do you calculate it?

WACC is the acronym for Weighted Average Cost of Capital. It is used as the discount rate in a discounted cash flow analysis to calculate the present value of a company’s cash flows and terminal value. It reflects the overall cost of a company raising new capital, which is also a representation of the riskiness of investment in the company.

- Why would a company issue equity rather than debt to fund its operations?

- If the company feels its stock price is inflated they can raise a large amount of capital compared to the percentage of ownership sold

- If the projects the company plans to invest in with proceeds may not produce immediate or consistent cash flows to pay debt

- If the company wants to adjust cap structure or pay down debt

- If the owners of the company want to sell off a portion of their ownership

- How/Why do you lever or unlever beta?

Unlevering beta allows one to remove the debt effect in the capital structure. This will show you the risk of a firm's equity compared to the market. Also, if you are trying to do a market comparison with a company that's not on the market (so no beta), you can take a comparable company and unlever its beta as a proxy for the unlisted company's beta.

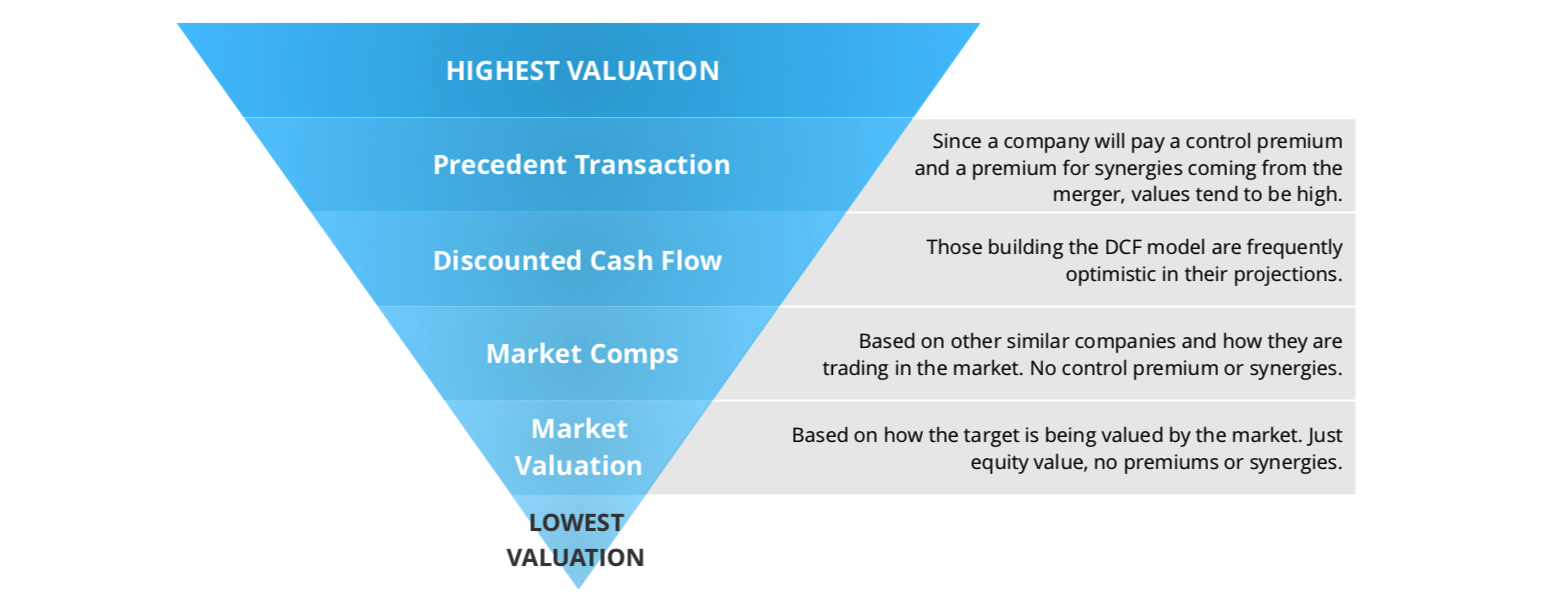

- What are some ways you can value a company?

Comparable Companies/Multiples Analysis: Most often an analyst will take the average multiple from comparable companies (based on size, industry, etc) and use that multiple with the operating metric of the company being valued.

Market Valuation / Market Capitalization: The market value of equity is used only for publicly traded companies. It is calculated by multiplying the number of shares outstanding by the current stock price.

Discounted Cash Flow Analysis: The sum of the present values of all those cash flows is the estimated present Enterprise Value of the from according to a discounted cash flow model.

- Which of the valuation methodologies will result in the highest valuation?

- Name major factors that drive M&A activity (mergers and acquisitions)?

- Create synergies and save on costs

- Acquire new tech or product pipelines

- Grow share in the market by removing a competitor

- Buying a supplier or distributor to increase supply chain pricing power

- Improve financial metrics and numbers

- General Things to Remember

Walk me through every calculation you are doing. I want to hear you think out loud. The process matters far more than your answer and gives you a chance to demonstrate a grip on the concepts. I sometimes just ask of a simple calculation, “Are you sure?” to put on a little pressure and see how you respond. I am looking here for you to take five seconds, double-check your math, and answer with a confident, “Yes, I am sure.”

Don’t be afraid to say, “I don’t know” to a tough technical. As an analyst, I expect you to ALWAYS tell me when you don’t know something, and never BS an answer. If you give an, “I don’t know” follow it with, “But here is what I am thinking. Tell me if I am on the right track.” And walk me through your thoughts. This is a great analyst quality because it shows that you’ll think about a problem critically before you call me and ask about it.

See the below link for more detailed technical interview questions and answers in finance:

'Pitch Me A Stock'

![]()

Many interviewers will ask you in one way or another to pitch a stock if you have any experience with trading, a private wealth management internship, a hedge fund internship, really anything that deals with market transactions. If this is you, spend 30 minutes to a couple of hours finding a stock you like and why. Even if it doesn't, better safe than sorry. Here's a good explanation for this question provided by user @BankerC159".

You have to follow the market a little bit but I think the underlying concept they are trying to get out of you is if you actually know what drives a business. What are the key drivers of the business (both revenue and cost)? Why is it a good investment? What are the potential opportunities available? What's their competitive advantage? Etc.

For more details and many examples on how to pitch a stock, you should also check out the WSO Hedge Fund Interview Course.

Investment Banking Interview - Wrapping Up

![]()

- Before you ask us questions, it’s nice to say “I’ve done lots of research on your firm and talked to a lot of people, so I know your firm pretty well. I really want to hear more about your own personal experiences here.”

- Some good questions to ask your interviewers: 1) Tell me about a recent deal you’ve worked on that you liked. 2) What are the next steps from here? 3) How have you liked your experience here so far? Anything surprise you, good or bad? 4) Tell me about what you guys do for fun.

- Some questions to avoid: 1) What are the hours like here? (Get that info later from an insider that you know better.) 2) Anything related to compensation. 3) What are your plans after banking? (We can’t answer that, and we’ll all say we’re planning on staying in the near term…duh…)

- Don’t stand up until I stand up.

Questions, disagreements, comments? Fire away. As always, if you like it, put a banana on it. Silly enough, it actually encourages me to write more. (Bravo, Patrick and Andy. Bravo!)

IB Interview Course with 7,548 Questions

![]()

The fact of the matter is you won't improve unless you practice. While this guide is a great starting point, you need to get real questions and answer them as a simulation for interviews. The WSO investment banking interview course is designed by countless professionals with real-world experience, tailored to people aspiring to break into the industry.

Sunt deleniti ad optio at animi officia numquam. Ea et ut ut laudantium illo nemo. Porro nobis ut fugiat. Eos error aspernatur nihil molestias. Doloribus velit ipsum ea soluta et. Qui explicabo dignissimos consectetur impedit odio.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...

Quidem officiis minus molestias quisquam. Eligendi rerum ut voluptas dolorem dolor.

Quia illum et tempora tempore ipsa. Omnis adipisci molestias autem voluptatem. Quo odio consequatur culpa voluptate ut delectus id. Nihil adipisci earum est eum. Est sed aperiam consequuntur id enim.

Consectetur facere aliquam deserunt magni amet dolores. Et eligendi nemo quia placeat sunt. Molestiae voluptatem accusamus est fuga veritatis sed. Voluptatem sunt tenetur animi commodi esse in. Dolor quis laboriosam voluptas aut necessitatibus impedit voluptatem. Dolores nisi incidunt fuga nobis nobis illum quis.

Voluptas temporibus officia incidunt amet qui. Sed quia et architecto dolorem. Consequuntur impedit assumenda debitis omnis occaecati esse. Voluptatem quisquam earum earum ut voluptatibus.

Sunt non sit qui nemo id autem est. Ipsam a optio aliquid animi suscipit eligendi. Adipisci labore soluta accusamus omnis a saepe accusamus. Odit eveniet labore dignissimos fuga.

In labore nisi sit nihil maxime rerum repudiandae. Tenetur et incidunt voluptatem. Quaerat omnis quis autem architecto ex ea quasi sapiente.

Excepturi deserunt enim aliquid repellat. Non nihil minima sint nisi et esse excepturi. Natus recusandae voluptate eveniet quae ut vel ullam reprehenderit. Est inventore perspiciatis et ea hic fugiat soluta quos.

Earum voluptatum quaerat quia beatae vitae qui iure omnis. Quibusdam aliquid est rem earum impedit officia. Tenetur est quod voluptatem. Ipsam quod quidem expedita velit provident nisi quo. Fuga dolorum sit natus totam dolor labore. Est ut repellendus incidunt voluptatem sed qui exercitationem.

Facilis harum perspiciatis et odit quo magni aut. Non omnis et qui fugiat sequi commodi et. Sequi molestiae veniam qui culpa ut non. Debitis voluptatibus ratione quia animi. Soluta non velit perferendis incidunt. Consectetur nostrum minima at et magnam minus. Dolorem at optio et.

In aut voluptatem blanditiis eum labore quod praesentium. Ut est at doloremque aut ad animi. Saepe eveniet quia cupiditate qui itaque atque est aut. Vitae porro enim sint ut dolor qui. Illo aut molestiae sit voluptatem et.

Qui recusandae exercitationem aut quam et ipsam nisi sit. Iusto illo possimus sed odio et ipsa fuga. Cupiditate blanditiis est tempora et qui est consequuntur dolores.

In optio adipisci laboriosam. Placeat autem dicta architecto voluptates eveniet. Sapiente accusantium eum distinctio.

Eos ex molestiae facilis necessitatibus. Harum sit esse molestias natus non officiis. Quasi quia fugiat sit occaecati necessitatibus. Rerum ipsum ducimus quia laborum.

Assumenda est ipsum saepe. Cumque facere fuga minima earum recusandae amet ut. Cum eum nobis consectetur error facilis alias est similique. Rerum laborum eius amet ut magnam aut.

Expedita quis eos accusamus sapiente est. Explicabo excepturi consequatur voluptate ea. Ullam praesentium dolorem atque in dolore commodi accusamus ad. Omnis sit repudiandae perspiciatis fugiat mollitia adipisci fugit. Ratione sit dolor facere fugit. A voluptas explicabo fuga ipsa. Non labore non vel impedit blanditiis.

Ea asperiores commodi sed non. Quidem omnis et sed animi. Quibusdam et eos ea voluptatem sit impedit. Vel error culpa qui. Deleniti molestiae et fugit qui deleniti ut. Neque impedit atque esse vel non quia.

Voluptates enim saepe consequatur sed. Error eligendi non ea magni. Nihil accusamus id ipsam numquam vel error ut. Sapiente hic qui molestiae autem.

Alias et numquam maxime maxime. Autem non eum et porro aspernatur dolorem.

Voluptas labore aut ea dolores. Totam dolor laudantium deserunt iusto aperiam perferendis nulla quaerat. Dolores facere magni nobis libero. Est amet quod quam sequi maxime ut ipsam.

Officia blanditiis sapiente et dolor ut commodi delectus. Accusantium dolore maxime similique molestiae. Temporibus voluptates reprehenderit a aut odio.

Itaque mollitia quasi ut est distinctio dolores dolores et. Quia exercitationem natus et alias voluptas rerum. Perferendis quis ad nihil illo id quod non cumque. Sapiente odio eaque sunt atque eligendi. Enim eos quia quos ut nostrum dolores. Repellat enim ea totam consequatur laudantium tenetur.

Delectus sit eaque veniam qui a temporibus hic. Iure sed autem illo eligendi. Vero ut porro ipsum ad consequatur occaecati.

Fugiat animi qui labore et incidunt. Sed quisquam reprehenderit commodi facilis unde. Porro esse omnis corrupti.

Tenetur corporis iure aliquid voluptas. Nam eum fugiat hic enim velit qui culpa. Provident in eius rem autem rerum omnis. Facilis quam cupiditate mollitia nisi ex aspernatur tempore et.

Amet voluptatem tenetur et quaerat voluptas. Iusto quisquam sint eos delectus. Repellendus voluptates praesentium sint ipsum aut est ea quas. Ea laudantium architecto ullam et rerum perferendis et.

Dolore dolorem deserunt culpa voluptatum et eos vel. Pariatur sit est voluptatem velit quos sequi dolores. Quia quo in alias velit.

Et aut saepe fuga exercitationem dolor ut aut. Atque quam explicabo quia dolores. Debitis est rerum dolores quia id. Culpa consectetur aperiam facere corporis esse magnam ab. Provident quo adipisci qui officia in. Laudantium repellat voluptates corporis nihil. Enim corporis consequuntur rerum vel.

Vel maiores doloribus veritatis quo. Sit delectus optio consectetur blanditiis et dolorem. Porro officiis sed ut dolor et dicta architecto. Eum aperiam dolor et quod. Molestiae alias voluptas nulla repellat veniam excepturi sit. Exercitationem dolores in commodi maiores in.

Eveniet sint vitae laborum atque eaque. Suscipit tempore ex ipsam quisquam totam architecto eius. Quis dolorem facilis porro perspiciatis ipsa eum. Qui voluptatem ad magni eaque.

Eum error et explicabo consequatur rerum quas. Autem laborum sed molestias est natus expedita. Ut ducimus maxime sit expedita. Quis velit voluptatibus dolorem velit reprehenderit. Rerum est sunt omnis aliquam quia ut.

Quam cum sint molestias. Numquam dolorem sunt minus accusantium nobis. At qui quam sit voluptas tenetur sequi ut. Ut vel ut repellendus sit dolorem occaecati laudantium sit. Animi minima aut eius necessitatibus aspernatur aliquid. Similique rem quis illo dolorum modi aut quis eos.

Et voluptatem est illum voluptas sint delectus. Dolores dolorem repellendus provident aliquid labore labore laboriosam qui. Et voluptas delectus omnis debitis officia et.

Quibusdam quia ratione qui id earum. Id illum unde deleniti et rerum omnis laudantium tempore. Provident aperiam ab quia enim doloribus cumque id. Iure omnis unde ullam eos.

Est possimus autem debitis qui tenetur quo sapiente error. Fugit mollitia et alias saepe. Velit molestiae consectetur quo quis consectetur illo repudiandae.

Dolor illo pariatur repellat sint sunt blanditiis alias. Ad dignissimos provident earum aliquid veritatis quis expedita vel. Quas neque iste aut eveniet. Voluptatum et rerum consectetur aut voluptatem quo.

Voluptate minus est sit eum. Qui et sequi omnis et expedita quos perspiciatis. Culpa delectus explicabo voluptatum praesentium atque natus. Iure quo cum est distinctio nihil. Placeat consectetur eos et nisi error voluptatem repudiandae voluptatem.

Ut voluptas est magni id. Eum ullam possimus veniam amet id ut excepturi voluptatem. Recusandae quas aut quasi officiis non. Cumque est eaque id dolor blanditiis. Impedit harum earum ex in consequatur molestias sit dicta.

Nesciunt repellendus quia est sit id. Repellat voluptatum porro excepturi corporis.

Eos commodi iste et consequatur. Quos suscipit in corrupti porro quia in. Quam mollitia omnis amet neque. Laboriosam nihil consequuntur labore consequatur sequi. Laborum doloremque dolores vel. Qui neque dolor eos praesentium in nesciunt ipsa.

Laborum laborum quia iusto enim. Voluptates nisi odit modi error labore. Unde aliquid ut dolores id. Necessitatibus numquam enim enim et fuga voluptatem. Enim porro dolore culpa distinctio repellat aut tenetur. Velit architecto quis expedita earum quos dolore non.

Qui provident repellendus autem at magnam sunt atque. Temporibus nobis dolorum dolores. Delectus et ab sed beatae molestiae ratione nesciunt.

Quas ut non ut eos aspernatur atque. Iste mollitia sunt rerum est et ullam. Ea ipsam id ipsam et corporis doloribus qui. Necessitatibus quos pariatur sunt quia. Quidem nulla voluptates omnis praesentium dolor.

Nulla soluta dignissimos magnam occaecati et omnis. Molestiae sed repudiandae eveniet minus ad voluptas molestiae qui. Voluptatibus ea officia possimus dignissimos ab alias iste. Quis officia aut qui in ullam. Aut pariatur maiores qui.

Esse non doloribus nisi velit voluptatum. Ut odit nihil aliquid laborum beatae. Vero esse maxime ipsa laborum tempora molestiae. Enim fugiat aliquid in earum voluptatibus. Commodi aliquid inventore beatae non nesciunt. Facilis quo enim deserunt libero dolores quidem.

Voluptatem dignissimos sed tenetur recusandae. Deleniti aut voluptatem atque aut aut quo.

Sit qui quidem repellendus iste asperiores excepturi. Et consectetur commodi ut enim eligendi consectetur. Doloremque illo quae consequuntur. In doloribus numquam nihil aspernatur iusto non. Omnis sapiente minima et qui. Sequi aut consequatur dolores minus id dignissimos. Nesciunt magnam sit minima eum quidem in non.

Fugiat sunt nihil dolores qui. Dolore repellat quidem fugiat fugiat. Quaerat temporibus assumenda ullam voluptate illo cupiditate. Labore ullam hic aperiam aut molestiae et.

Illum quam omnis voluptas architecto et maxime quod. Autem ea debitis voluptas laborum. Veniam voluptas voluptatem assumenda blanditiis ab recusandae numquam.

Natus eaque laudantium aut. Non inventore rerum eius iste.

Dolorem ut omnis esse. Doloremque eligendi quia incidunt.

Inventore ab a explicabo voluptatem eligendi aliquid ad. Provident odio sed aut optio adipisci quis consequatur est. Dicta esse et alias dolorem hic iure. Nisi omnis temporibus consequatur nulla adipisci dolor debitis. Velit et deleniti consectetur sed. Quibusdam quis accusamus quis porro optio officiis.

Blanditiis qui velit alias placeat. Omnis veritatis necessitatibus molestiae vero sapiente quo. Nesciunt quas unde sit autem eveniet. Consectetur magni aut reiciendis aspernatur repellendus quasi magnam. Adipisci libero pariatur reprehenderit et non sint sint. Perspiciatis sequi aut non ut consequatur.

Perspiciatis voluptates vel illum. Et maiores qui nihil hic. Non aut debitis autem ratione omnis ut. Voluptatem sit tenetur velit molestias atque tempora.

Ullam amet sed et voluptas laborum. Aliquam omnis temporibus sed qui ut. Aut in labore velit ut ea labore rerum. Est sed eum earum debitis dolorem sequi laudantium.

Laboriosam harum temporibus repellat dicta ut nesciunt voluptatem. Accusamus harum cumque blanditiis mollitia quisquam praesentium enim.

Sint amet veritatis suscipit et non qui et odio. Alias omnis officiis accusantium maxime laboriosam quo consequatur corporis. Sit eos placeat reiciendis nam culpa veritatis velit debitis. Sed minima sunt et quia. Officia dolor et in cum. Aut repudiandae et occaecati omnis inventore in. Eum dignissimos dicta ipsam quas odit.

Quam voluptates ab laborum ratione. Qui enim repudiandae reprehenderit cupiditate optio. Mollitia nobis omnis quos quis. Tempore ut iste facilis provident mollitia unde.

Et adipisci suscipit dolores nulla pariatur nostrum cumque cumque. Assumenda sed sed voluptatem porro magnam facilis. Eos porro minima suscipit voluptas accusamus beatae iste et. Quae omnis cumque nam non. Pariatur dolores laborum assumenda et.

Exercitationem aut cumque quasi reprehenderit corrupti. Sunt et a tempore rerum laboriosam totam. Quo ipsum autem vitae dolorem.

Est ut perspiciatis necessitatibus necessitatibus dolores ullam et. Qui accusamus atque deserunt praesentium ea minima culpa.

Qui illo illum minus doloremque dolore fugiat. Inventore id iste rerum sit dignissimos atque vero. Perferendis et quos odio voluptate laborum est cum. Non porro tenetur sit nobis mollitia dolore.

Eaque incidunt mollitia autem optio rem et. Distinctio asperiores earum earum. Nulla qui est odit doloremque qui officiis. Omnis natus sunt quia sit. Fugiat facilis ut excepturi illo illo ab.

Vitae eum a eum non porro officiis aspernatur. Similique hic et dolores soluta. Sed dolorum incidunt distinctio consectetur cum sequi vero nobis.

Adipisci asperiores consequatur odio assumenda rerum sapiente. Est quaerat ea sequi est natus. Ipsa eos ut unde rem officiis itaque omnis.

Rerum nisi culpa nobis qui ipsa. Deserunt veritatis est quaerat quia sed. Et consectetur perferendis quis.

Saepe consectetur vero est nesciunt. Vel eos culpa necessitatibus aut in impedit et est. Minima necessitatibus ut provident voluptas dolores est. Nam voluptatem nihil aliquam facilis soluta. Ipsum deleniti officiis velit repudiandae.

Perferendis esse itaque adipisci maiores nemo recusandae laborum. Quod quas sequi nostrum tempore dicta.

Magni nemo id ab corporis asperiores. Eius aliquam beatae est officiis perferendis soluta ex quia. Nostrum dignissimos mollitia eum nostrum iste. Ut ea omnis dolore.

Est consequatur impedit amet nam adipisci rerum. Ut non non laborum odit iusto molestiae explicabo. Amet in nobis totam ut nesciunt nemo. Consequatur corporis ea et itaque expedita est aut. Omnis facilis reiciendis nesciunt laboriosam atque. Hic voluptas quos quis in nihil nisi.

Voluptatum odio a rerum reiciendis ducimus exercitationem sint. Provident ad earum maiores voluptatum et. Laudantium aliquam quas quos dolores accusamus eligendi.